Components Of Credit Score You Need To Know

- By John Miller

- •

- 04 Aug, 2017

- •

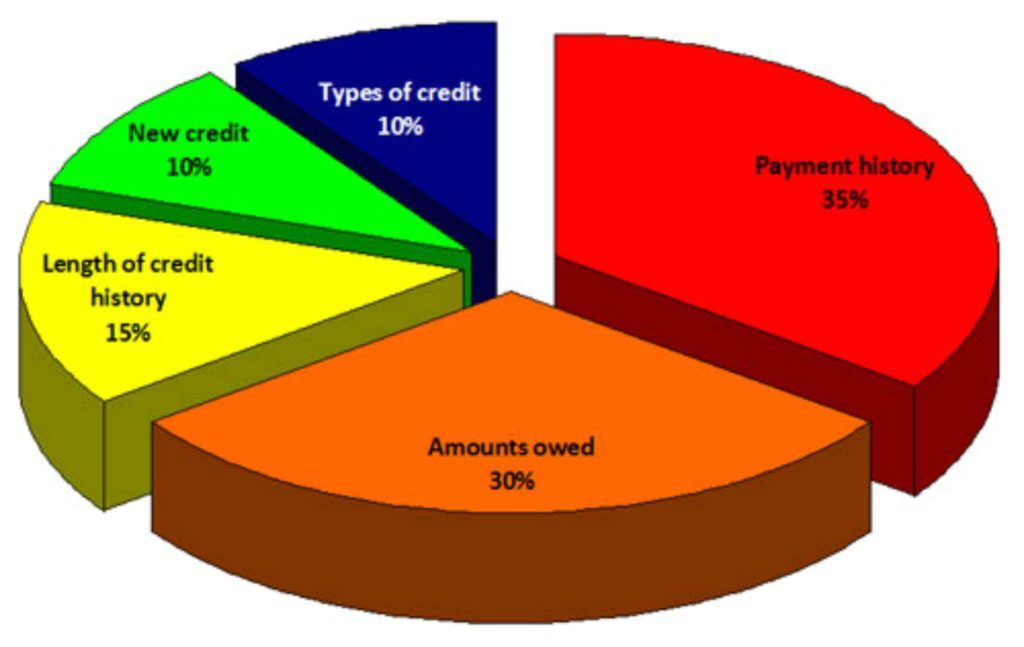

You very well know the importance of a high credit score. But did you know why your score drops down? To understand that, you first need to learn various factors that determine your credit score.

Furthermore, you can enter into a long-term contract with authentic credit repair company to keep your score high. The professionals such as keycreditrepair.com

provide you best services at an affordable cost that not only improves your score but also maintains it.

Nevertheless, as mentioned above the first step to enhance your credit score is to recognize the components of credit score.

Payment History

You may be knowing that your payment history has the highest impact on the credit score. It has 35 % stake on your score which in a way is a good thing. Simply by keeping a good track, you win half of your race.

Debt Burden

The debt you owe has 30 % of stake on your score. It contemplates various elements such as how much credit is availed, how much do you owe on an account like mortgage, credit cards, etc., how much do you owe in total and in comparison to the original amount of installment.

Time in File

In simple words, it’s your length of account that has 15 % of stake on the score. The longer is your history; the better impact it has. It takes into account your length of each account and the duration of time of account’s most recent action.

Credit Mix

Considering 10 % of the stake, the credit mix counts on the various loans you have taken such as mortgage, credit cards, home loan, etc.

Recent Search for Credit

Lastly, your recent credit search holds 10 % of your score. This includes the credit recently taken and the inquiries you have made for credit.

As you know the impact of these components on your score now, make sure to pay your credit bill regularly and keep a good track record to boost your credit score quickly.